U.S. production continues to follow oil price's rules of engagement.

But Saudi Arabia's new policy directions may upend the cartel's cohesion.

Mixed signals make bear and bull arguments feasible.

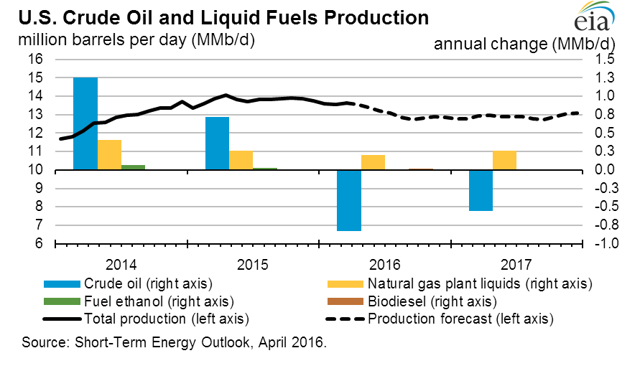

Conventional wisdom and economics say U.S. oil production will decline because prices are low enough to dissuade previous production levels, and indeed this is the case. Roughly 600,000 barrels had come off of the U.S. tally for crude oil production in March 2016 from an April 2015 peak of 9.6 million barrels per day (b/d). U.S. shale players are expected to further reduce their production output as prices in the $40 range hold back production for many of the shale basins in the U.S. On Friday, April 29th, Brent crude oil futures prices for June reached $47 and WTI nearly reached the $47 level.

Some of the headwinds for the U.S. industry beyond price are idled equipment and labor cuts. Both will slow the recovery expected. According to Scott Sheffield, CEO of Pioneer Natural Resources (NYSE:PXD), a leading shale player, he stated that the idea of the U.S. becoming the swing producer is not realistic, contrary to OPEC's thinking. The damage exacted upon the U.S. oil and gas industry's operations will take one-and-a-half to two years to return to higher capacity levels. Add to that, balance sheet de-leveraging also will restrain the ability to spend cash on drilling new wells.

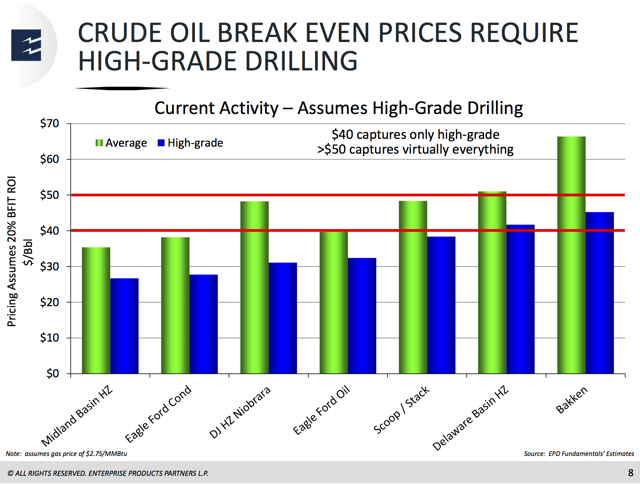

Additionally, relative to U.S. production, hundreds of independent oil and gas firms plus majors produce oil and related liquids, scattered across five of the heaviest-producing shale basins, the Gulf of Mexico, California and Alaska with varying points of profitability. Recently a large midstream firm, Enterprise Products Partners (NYSE:EPD), assessed that to drill crude oil, high-grading was required, meaning firms concentrate on their best, most profitable rocks.

(Source: Enterprise Products, Howard Weill conference 3/21/16)

Relative to that exercise, a $40 price level is said to capture the main oil basins for high-grade drilling. Above the $50 mark, then the average drilling cases are captured for a 20% return on investment (before federal income tax). However, in the case of Pioneer, with the Eagle Ford oil window having a $40 average drilling price to make that return, they state that they will begin drilling their Eagle Ford acreage at $50. Pioneer's Permian Basin acreage competes with its Eagle Ford acreage.

In this simple example, one sees the complexity in determining how one firm, much less the entire U.S. industry, will behave competitively. One truism has emerged though as stated by Occidental Petroleum's (NYSE:OXY) outgoing CEO Chazen: "asset quality is everything because of the nature of oil." Nothing like a downturn to reveal who is managing those assets well - and which firms are adjusting to find new opportunities.

Changing cartel dynamics

And OPEC will likely continue to pump to maintain market share. April production was up 170,000 barrels a day month-on-month at 32.64 million barrels a day, close to a recent high. Several members such as Kuwait, Venezuela, Nigeria and the UAE were producing in shortfall mode even. With U.S. and other global production declining, there is no incentive to cut back yet. The gambit to gain share is working, however at the cost of political and economic instability as the days of $100 oil can no longer prop up national budgets. Prince Muhammed Bin Salman however conveyed the new Saudi Vision 2030 plan to diversify the Saudi economy away from its over-reliance on hydrocarbons. The oil worker strikes in Kuwait also are a sign of the times.

An unintended consequence of the advent of U.S. and OPEC's market play is an unleashing of greater uncertainty in oil markets than previously existed. It is true anecdotally that the U.S. addition of shale resources had a moderating impact on price swings in the pricing run-up to mid-2014. Previous oil price spikes due to unplanned outages were not as prevalent then. OPEC had been predictable, to a degree, as to their rationales. U.S. shale resources, Iran online, Saudi regime and economic policy changes, and China's economic rebalancing are shaking the order. Not to mention how investment flows are behaving in a low interest rate world.

The oil market appears to not only be identifying what the new normal is, but what signals to follow even. Fortunately, the global economy is a large multi-player game. Increased U.S. hydrocarbon production has changed the playing field, thus OPEC is finding its own bearings in this changing order. Saudi Arabia may be re-writing the rulebook for its cartel members, while steering its economy into a more progressive 21st century model.

We are in the days of unconventional production and emerging policies influencing the energy world's order.